Written by the Mackenzie Betterworld Team

Market overview

In April, equity markets were rattled by a sharp 20% intra-month pullback following the U.S. tariff announcement on April 2, coinciding with “Liberation Day” volatility. However, a 90-day extension from the Trump administration helped stabilize sentiment, allowing global equities to recover and finish the month in positive territory. Economic data came in line with expectations, showing limited immediate tariff impact, while front-loaded purchases ahead of the tariff deadline offered temporary support. Positive signals from China on potential trade talks and a sizable drop in oil prices since January helped offset inflation concerns. Despite improving sentiment, elevated valuations at 20.5x next year’s earnings for the S&P 500 suggest a cautious outlook remains warranted.

Portfolio and Sectors review

Mackenzie Betterworld Global Equity Fund

The Mackenzie Betterworld Global Equity Fund outperformed its benchmark (MSCI World ex Fossil Fuels Index) for the month. Stock selection in utilities and industrials contributed most to portfolio performance while stock selection in consumer discretionary detracted to portfolio performance.

German industrial and energy multinational Siemens Energy saw its share price climb steadily throughout the month after pre-releasing a strong second-quarter earnings report, with EBITDA guidance coming in 12% above analyst consensus. Backed by a robust order book in grid technology and gas turbines, the company is expected to hold over €5.5 billion on its balance sheet in 2025—positioning it well to begin issuing dividends in 2026.

Renewable power producer EDPR saw its share price rise steadily throughout the month, reflecting a recovery from earlier challenges related to weaker power generation and cost headwinds in Europe. While expectations for reduced cash generation due to limited asset rotations may put pressure on debt levels in 2025, the Betterworld team remains encouraged by management’s proactive communication. EDPR’s reaffirmation of its strong positioning for U.S. development opportunities, pending greater policy clarity, highlights the company’s strategic agility.

Mackenzie Betterworld Canadian Equity Fund

The Mackenzie Betterworld Canadian Equity Fund slightly underperformed its benchmark (S&P/TSX Composite Fossil Fuel Reserves Free Index) in April. The fund's stock selection in the materials and the financials sectors detracted to portfolio performance. However, overweight allocations in the industrials and consumer discretionary sectors contributed positively to the portfolio's overall performance.

Gold continued to serve as a reliable hedge against uncertainty throughout the month amid market volatility. The Fund's exposure to gold helped offset the weakness experienced with copper. Portfolio companies like Agnico Eagle, a leading firm in the gold sector known for their strong sustainability practices, helped mitigate the relative underperformance of the fund in the materials sector.

Proxy Voting

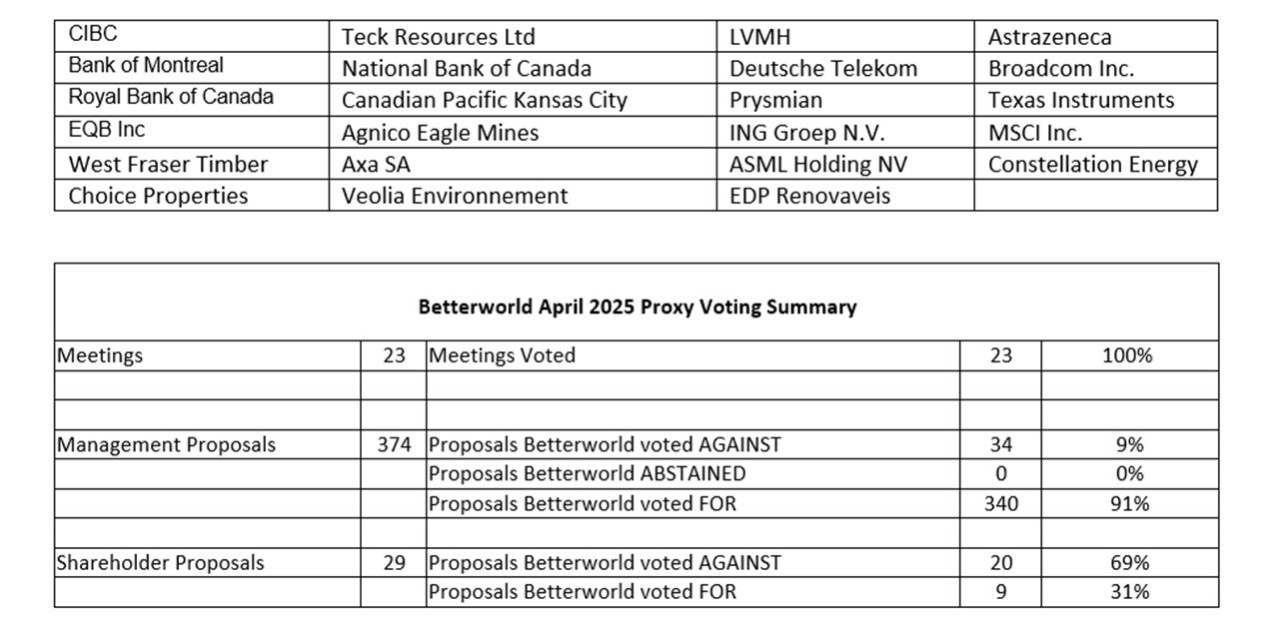

April marked the beginning of proxy season, with a notable increase in annual shareholder meetings. The Betterworld team participated via proxy in 23 meetings—14 in North America and 9 in Europe.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

The contents of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) are not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This document may contain forward-looking information which reflect our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of April 30, 2025. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

This material is for informational and educational purposes only. It is not a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. It is not intended to address the needs, circumstances, and objectives of any specific investor. Mackenzie Investments, which earns fees when clients select its products and services, is not offering impartial advice in a fiduciary capacity in providing this sales and marketing material. This information is not meant as tax or legal advice. Investors should consult a professional advisor before making investment and financial decisions and for more information on tax rules and other laws, which are complex and subject to change.